missoula property tax increase

Missoula County is proposing an 8 percent increase in property taxes to balance its new annual budget and its also calling on the state to fix what commissioners have deemed a broken tax system. Property Tax data was last updated 04222022 0700 PM.

Property Taxes Missoula County Blog

Average Missoula County home 15 assessed value increase to 350000 for fiscal year 2022 140 increase in county portion of property taxes.

. 1 weather alerts 1 closingsdelays. If adopted as-is the preliminary budget would mean an estimated property tax increase of 1734 on a 350000 home or 145 a month. Missoula County has one of the highest median property taxes in the United.

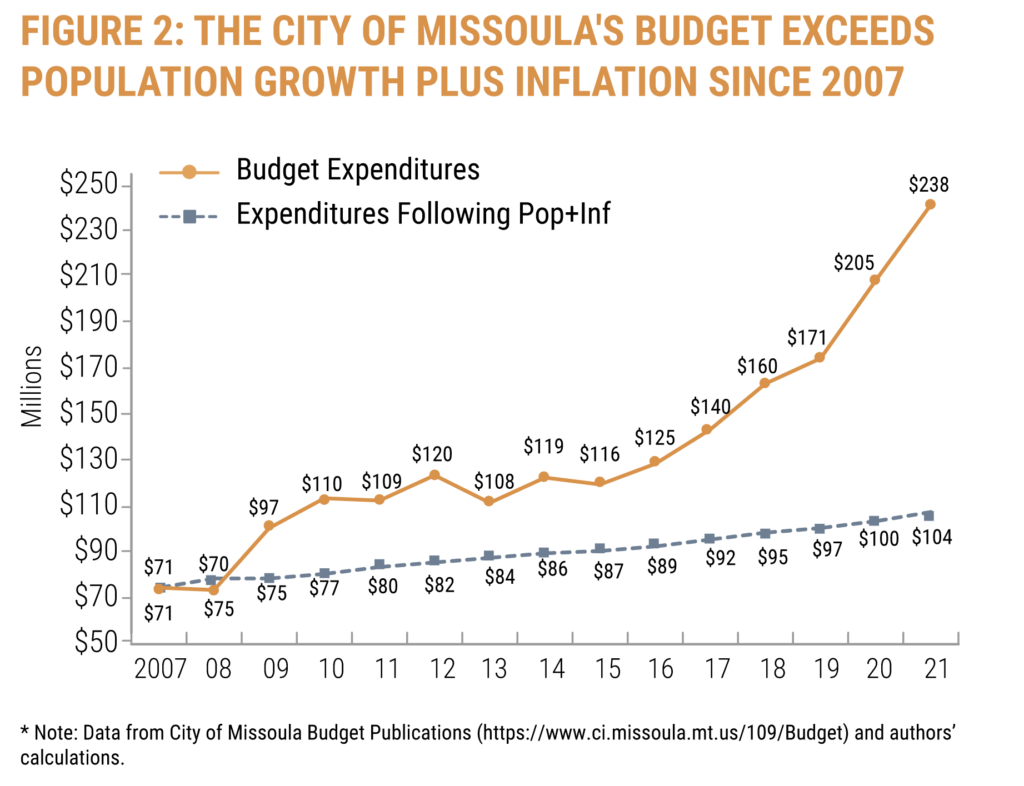

Missoula County Youth Court. Missoula mayor proposes property tax hike to pay for 385 percent increase in city spending. 093 of home value.

Yearly median tax in Missoula County. Discusses 2 property tax. Missoula County Road Building - Seeley Lake.

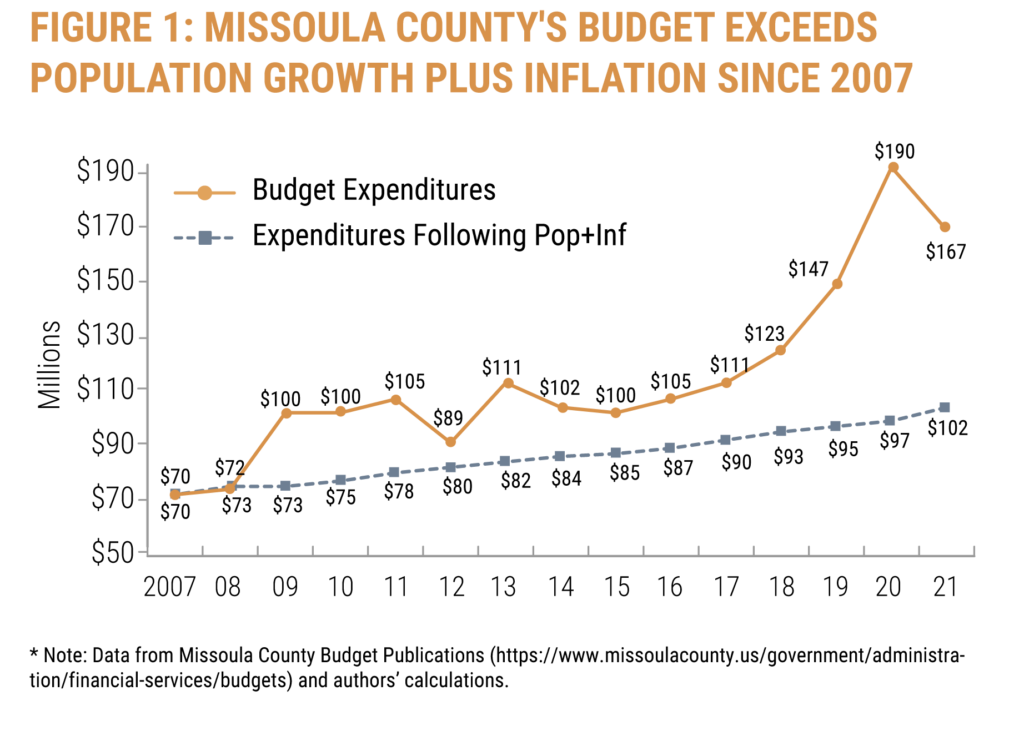

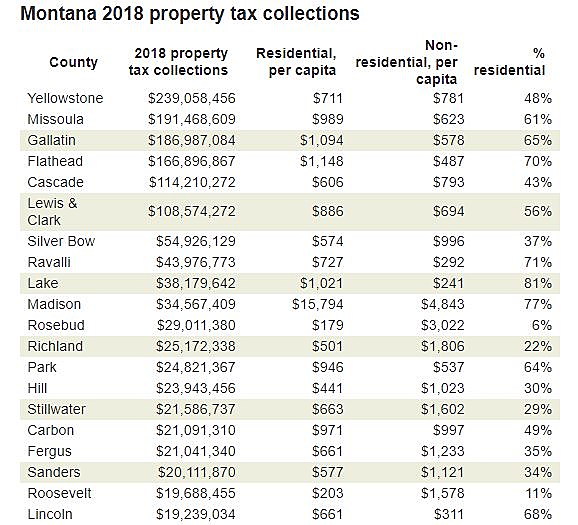

A dozen new ongoing requests would require new property tax dollars. These increases are considerably higher than Montanas average yearly property tax increase of 5 and drastically higher than the national yearly property tax increase average of roughly 32. Missoulas mill levies are about 10 percent higher than the average of the seven cities while Bozemans are about 13 percent lower.

Discusses 2 property tax increase for new budget requests KECI Montana property taxes keep rising New appraisals shock How do property taxes in Missoula Mayor funds full budget with reduced tax rate Missoula Real Estate Market Trends And Forecasts 2020 Missoula Co. Initially Missoula County had asked for a 11-mill levy increase but now they will only be asking for just over 8-mills. The accuracy of this data is not guaranteed.

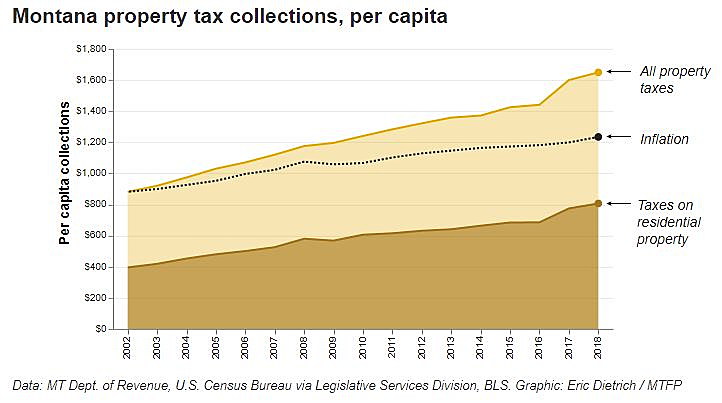

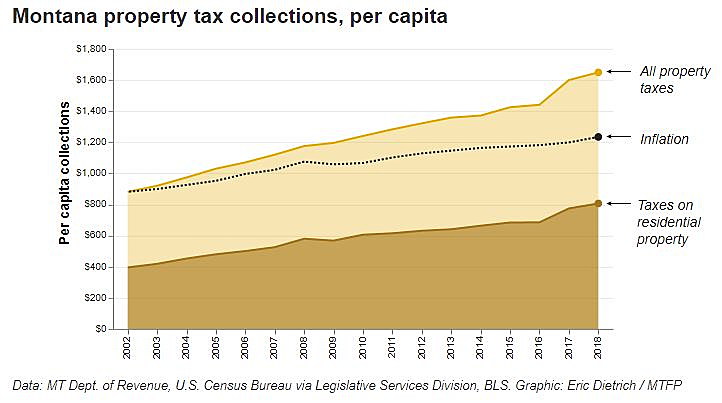

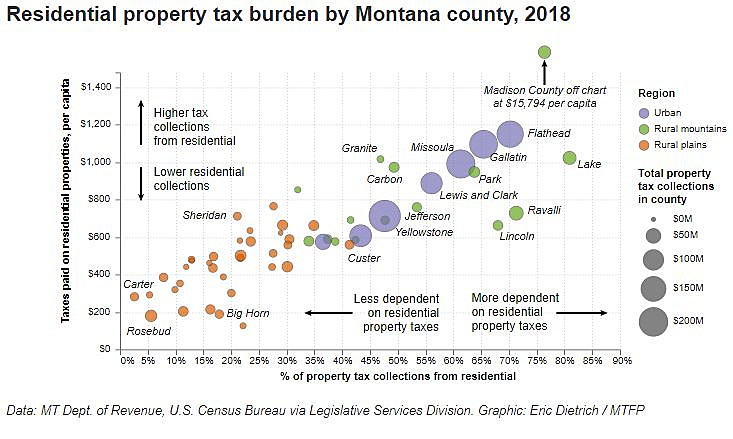

The fiscal year 2021 budget for Missoula County will raise taxes for residents with a 350000 home who live outside the city limits and only pay county taxes an additional 1436 per year. By Martin Kidston August 30 2019. On average Montanans paid 395 per capita in residential taxes in 2002 and 806 in 2018 an increase of more than 100.

Partnership Health Center - Alder St. Missoula County is proposing an 8 percent increase in property taxes to balance its new annual budget and its also calling on the state to fix what commissioners have deemed a broken tax system. Local property taxes in Montana are higher than Montanas state property tax.

Missoula County - Seeley-Swan Search Rescue. While it may seem small a few. Local taxing jurisdictions local schools Missoula County and the City of Missoula set their budgets and send millage rate information to Missoula County which mails tax bills for all jurisdictions.

The report found that the average yearly increase in each homes property taxes from 2016 to 2020 were 74 8 and 65. Missoulas problems are even worse when compared to property tax increases nationally which increased at an average rate of 32 between 2016 and 2020. The countys budget for the 2021 fiscal year includes 1707 million in overall revenue with 544 million in property taxes.

If you are considering moving there or only planning to invest in the citys property youll discover whether the citys property tax rules are well suited for you or youd rather look for another place. Outside the reappraisal costs the budget adopted by the county will increase property taxes by 1021 for a 350000 home outside city limits. Residents inside the city will see no tax increases.

Understand how Missoula applies its real property taxes with this detailed outline. Residential property tax collections have risen on a per capita basis faster than inflation over the past 16 years in 53 of Montanas 56 counties according to a Montana Free Press analysis of the tax study data. Add in a personal property tax rate of 016 percent and that brings up the total cost to 19045.

Missoula County Weed District and Extension Office. Thats more than double the rate of the house with the smallest increase in our analysis house three. The bills are mailed in October and taxes are due at the end of November and the end of May.

Discusses 2 property tax increase for new budget requests KECI New appraisals shock Montana property taxes keep rising New appraisals shock Dissecting the tax bills hitting Missoula city and county mailboxes Local News missoulian Montana property taxes keep rising Dissecting the tax bills hitting Missoula city and county. Missoulas mill levies are the second highest at the county level and. In fact if you took that homes property taxes in 2016 and applied the national average property tax increase.

Dozens gathered at the city council chambers on Monday to voice their opinion about the Missoula city budget in one of the longest city council meetings in recent memory. You are visitor 4860914. Are Montana taxes high.

Missoula County collects on average 093 of a propertys assessed fair market value as property tax. The median property tax in Missoula County Montana is 2176 per year for a home worth the median value of 233700. Under the new budget Missoula County residents with a 350000 home who live outside the city limits and only pay county taxes will pay an additional 1436 per year in property taxes and homeowners within city limits with a home of.

Montana property taxes keep rising Missoula Co. The county is set to adopt the budget on Tuesday. In 2019 Montanas property tax rate was 10th at a rate of 1509capita and the 19th highest in monies collectedcapita in the US.

Missoula County Superintendent of Schools. County Services City of Missoula home 0 overall increase for county services andvoter-approved bonds Missoula County home 1021 increase for county services and voter-approved bonds. Missoula County - Seeley Lake Office.

The county is set to. Read the detailed list of budget requests online or view the slideshow above. Table 1 displays property tax mill levies by use.

New Policy Brief The Real Missoula Budget

Proposed 2022 Initiative Would Cap Montana Property Taxes Assessment Values Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Ci 121 Montana S Big Property Tax Initiative Explained

Property Taxes Missoula County Blog

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Property Taxes Missoula County Blog

Missoula County Adopts Fy22 Budget State Reappraisals Lead To Property Tax Increase Missoula Current

Property Taxes Missoula County Blog

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Missoula City And County Legislature Failed To Provide Meaningful Property Tax Relief Missoula Current

Montana Property Taxes Keep Rising But Missoula Isn T At The Top Missoula Current

Analysis Average Priced Missoula Homes Seeing Massive Property Tax Increases

Property Taxes Missoula County Blog

Montana Property Taxes Keep Rising Here S Where Residents Shoulder The Heaviest Loads Montana Free Press